Digital currency innovations in Africa: What should policy makers take into consideration?

As Sub-Saharan Africa leapfrogs into the digital age with digital currencies, economists from the International Monetary Fund (IMF) weigh up the risks and opportunities of different types of digital payment instruments.

By Habtamu Fuje, Saad Quayyum, and Tebo Molosiwa

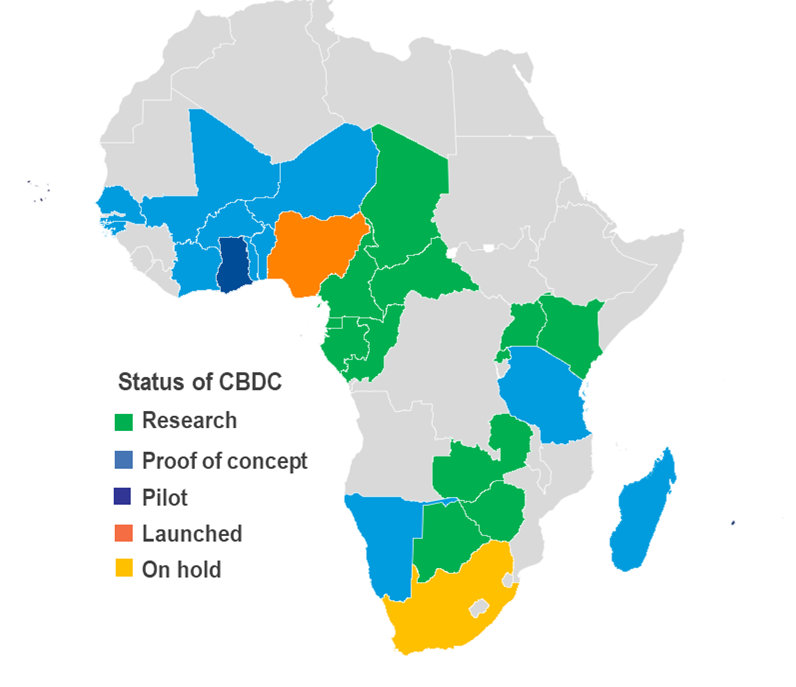

Policymakers in sub-Saharan Africa are looking to improve financial inclusion and efficiency of payments through digital currencies. Privately issued mobile money such as M-Pesa has long played a momentous role in the region, particularly in East Africa. More recently, fourteen central banks are considering central bank digital currencies (CBDCs), with Nigeria taking the lead in issuing the first CBDC of the region—the eNaira (Figure 1). The latest International Monetary Fund’s Regional Economic Outlook for sub-Saharan Africa outlines the promises of digital currencies for the continent and the potential risks.

CBDCs and mobile money could promote financial inclusion

Digital currencies are digital versions of cash that can be stored and transferred using electronic devices such as mobile phones. They could improve the lives of the poor by facilitating access to financial services and providing options for faster and cheaper payments and transfers. This is particularly important since many people in sub-Saharan Africa do not have bank accounts or access to ATMs.

Mobile money has been at the forefront of promoting financial inclusion. Customers can open accounts linked to their mobile phone numbers and use them to transfer money, make payments, and exchange mobile money for cash at low cost. The cost of sending remittances also tends to be lower through mobile money than banks or other money transfer operators. Vendors that transact using mobile money will build up transaction histories that could later open the door for a loan from financial institutions.

CBDCs are another form of digital money that allows person-to-person transactions, without the need for internet connectivity or bank accounts. The main advantages of CBDCs are that they are fully backed by central banks, and they can be designed to facilitate transactions across different mobile money providers, enhancing their interoperability. In addition, CBDCs could enable central banks to keep a foothold in the digital retail payment space and not let it be completely dominated by a single private provider. However, to be widely accepted, they need to be implemented well.

Cryptocurrencies pose significant risks and should be regulated

More recently, riskier forms of digital currencies, like cryptocurrencies, have gained some traction in the region with customers using them as a medium of payment in some countries including Kenya, Nigeria, and South Africa. But cryptocurrencies pose significant risks and should be regulated. First, their volatility can inflict large financial losses on customers, particularly those with limited financial literacy. Policymakers are also worried that they can be used to circumvent domestic capital control rules and transfer funds illegally out of the region. Furthermore, they pose broader financial and macroeconomic risks.

Policymakers should carefully weigh the benefits of these types of digital currency against their risks—CBDC and mobile money offer more benefits and are associated with less risk than cryptocurrencies.

Figure 1. CBDC Development Status in Sub-Saharan Africa, 2022