Africa’s financial executives cautiously optimistic on 2025-27 growth

While French Development Agency (AFD) projects Africa’s economy will grow by 4% in 2025 (up from 3.7% in 2024), Africa’s financial leaders have mixed confidence in their own growth prospects, the latest AFIS-Deloitte Barometer reveals.

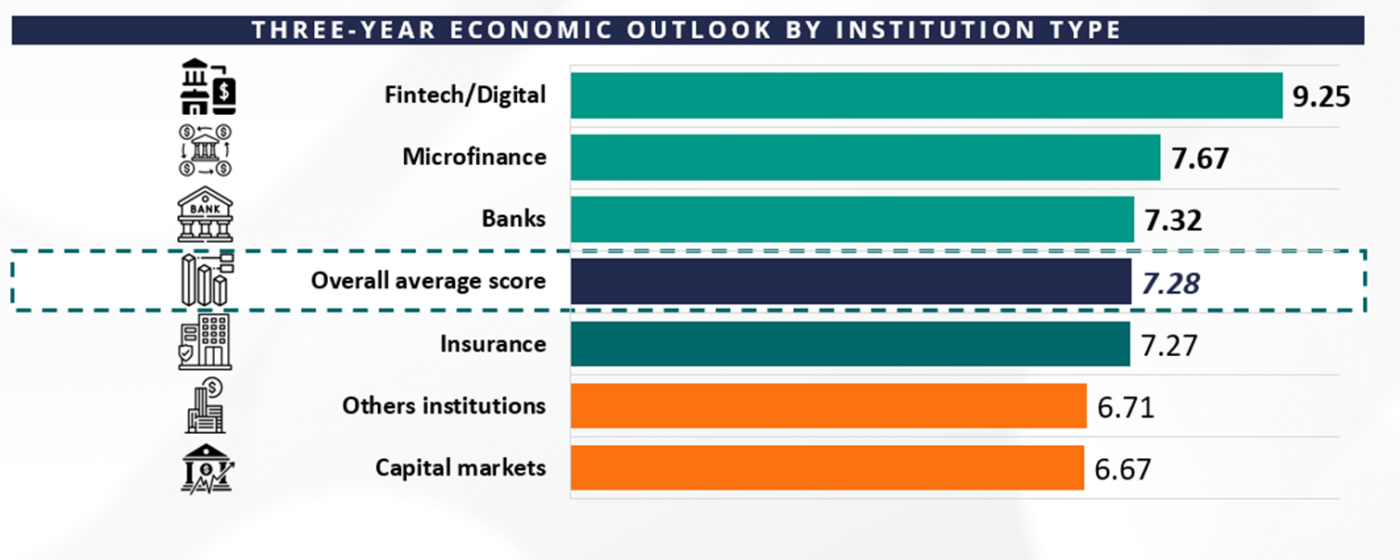

The fourth edition of the Barometer – by AFIS and Deloitte – surveyed banks, fintechs, insurers and capital market players, asking them to rate their organisations’ three-year economic outlook from 1: Very negative to 10: Very positive.

The majority of respondents were moderately optimistic, ranking their growth prospects at 7.28. However, this was a more pessimistic stance than in the previous year’s Barometer survey, where 56% foresaw a positive outlook, 39% a stable outlook and just 5% anticipated a negative outlook.

Fintechs expect growth

In this year’s survey, fintechs were the most optimistic, ranking their growth prospects at 9.25 out of 10.

This is in line with fundraising trends for fintechs. South African neobank TymeBank and Nigerian fintech Moniepoint both raised significant funds last year to become unicorns valued at over $1bn.

And although African startup funding declined 7% to $3.2bn in 2024, according to recent report by Partech, fintechs bucked the trend, attracting 60% of total equity funding.

Opportunities for partnerships with traditional financial institutions in areas such as alternative credit scoring, Insurtech, digital investment platforms and embedded finance underscore why fintechs are the most hopeful.

Capital market companies the most pessimistic

In contrast, capital market players rated their growth prospects lowest among all actors at 6.67/10.

The Barometer found that 57% of respondents found capital market access for fundraising insufficient, highly insufficient, or non-existent.

Structural challenges for capital markets – including small and few listings in equity markets and weak pricing benchmarks and low liquidity in bond markets – may explain their pessimism.

Speakers at AFIS 2024 in Casablanca highlighted that African capital markets are dominated by the public sector and serve primarily as government debt platforms. They called for more sophisticated products and looser investment limits for institutional investors.

Insurers more cautious than banks

Insurers remain optimistic about their three-year growth outlook but are less confident than banks. Rising underwriting risks from climate extremes, inflation challenges, and competition from Insurtechs are reshaping the industry.

While regulators such as Kenya’s Insurance Regulatory Authority project steady growth for their domestic markets, Africa’s $63.6 billion insurance premium in 2023 still accounted for just 0.9% of the global market.

With 68% concentrated in South Africa and insurance penetration rates below 2% in many countries, the sector has vast untapped potential but faces significant hurdles.

State of the Industry: Barometer Presentation

📺Watch Ramatoulaye GOUDIABY, Director of AFIS at Jeune Afrique Media Group, and Hicham BELEMQADEM, Managing Partner, Audit & Insurance, Maroc, Deloitte, present key insights from the latest Barometer.

👉 Download the full Deloitte-AFIS African Financial Industry Barometer for in-depth analysis and strategic insights.